Anyone sticking to a budget and wanting to know where their money is going most likely uses financial software. In fact, I've rarely seen someone be successful with their money without using some type of software tool to help (even if it's just Excel).

1-16 of 134 results for 'quicken 2018' Showing selected results. See all results for quicken 2018. Quicken Starter 2018 Release – 24-Month Personal Finance & Budgeting Membership. Quicken For Mac Personal Finance & Budgeting Software 2015 [Old Version] by Intuit. Currently unavailable. See newer version of this item. Quicken alternatives free download - Quicken Deluxe 2018, UCBrowser Alternatives for Windows 10, FacetimeApp Alternatives for Windows 10, and many more programs.

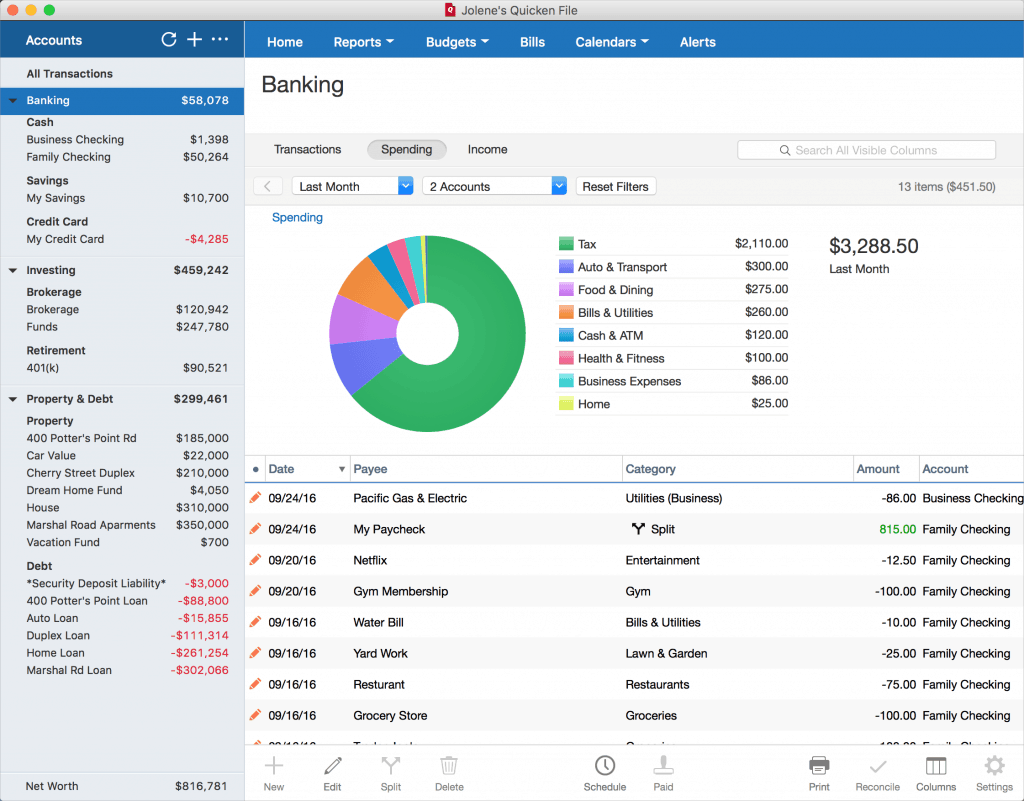

Often this means Quicken. But Quicken isn't the only game in town. In fact, over the last several years we've seen some struggles with Quicken (especially Quicken for Mac), and other awesome tools come onto the market.

In this article, we look at several Quicken alternatives that offer interesting features and can cost less.

Personal Capital

Personal Capital is a focused on investment management rather than budgeting. It does include budgeting, net worth and a great looking dashboard of your financial life.

But its budgeting feature isn't as strong as the above three apps.

If you are wanting to view your investments and understand how well they are performing, this is where Personal Capital shines. You can sign up for free and sync your investment accounts. Or sync all accounts if you want to see your net worth.

Personal Capital has strong analysis tools and helps you discover hidden fees in your investments. You'll be able to look at various retirement scenarios and understand if you are on track or not.

Personal Capital can manage your money and provide access to financial advisors for a 0.89% fee up to the first $1 million. There after, the fee continues dropping to 0.49% once you are over $10 million.

Personal Capital's app is available via web and mobile.

Mint is made by the same company that created Quicken - Intuit.

Mint comes in two forms - website and mobile app. It's an incredibly simple app to use. Your monthly spending and income are front and center when you log in. This lets you know right away if you are spending more than you should.

To setup a budget, you'll want to sync your accounts. Once you've synced various accounts with Mint, it will begin pulling in transactions from these accounts.

All transactions are located in one place. Mint does a good job of sorting your transactions into categories. You'll want to go in periodically and tweak them in case something has gone into an incorrect category.

With your accounts synced and transactions categorized, you can begin setting budgets on broad categories. Next time you log in, you'll see each category with color codes, letting you know if you've gone over your budget and by how much.

You'll find that Mint is very easy to use and reliable. It's also free.

You Need A Budget (YNAB)

YNAB stands for You Need A Budget. Budgeting is it all YNAB does. It's also very good at it. YNAB makes you give every dollar a job. This means you assign each dollar of income to a category, virtually cutting out any chance that you'll spend money spontaneously.

Categories are setup to group expenses. If you happen to go over in one category, you can take from another category to cover the difference.

Eventually, the goal with YNAB is that you are living off of the previous month's income. The way you get there is through consistent use of YNAB and making sure you follow its rules, which is difficult not to do.

YNAB can be installed as a desktop app on Windows or Mac, mobile app on Android or iPhone or simply run it from the web. It offers a 34-day trial and thereafter will cost $83.99/yr. YNAB is able to justify this cost through the amount you'll save by using the software.

The following is from their website, 'On average, new budgeters save $600 by month two and more than $6,000 the first year! Pretty solid return on investment.'

EveryDollar is the budgeting app created by Dave Ramsey's company. Similar to YNAB, EveryDollar follows the zero-sum budgeting concept, which is the same as 'give every dollar a job'.

EveryDollar has free and paid versions. The paid version has a 15-day trial and cost $99/yr. Without the paid version, you can't sync your accounts, which means you'll have to manually enter in every transaction. The paid version pulls them in automatically.

If you are familiar with Dave Ramsey's Baby Steps system, EveryDollar follows them. You'll be able to automatically see which step you are on.

EveryDollar focuses on budgeting. That's all it does. If you follow the Baby Steps and want a way to track them through a budgeting app, EveryDollar is for you.

EveryDollar is available online and on mobile.

Conclusion

Quicken has been around for a while and use to be one of the only financial management app worth using.

With the rise of so many fintechs offering great alternatives, Quicken is no longer king of the hill.

If you are familiar with Dave Ramsey's Baby Steps system, EveryDollar follows them. You'll be able to automatically see which step you are on.

EveryDollar focuses on budgeting. That's all it does. If you follow the Baby Steps and want a way to track them through a budgeting app, EveryDollar is for you.

EveryDollar is available online and on mobile.

Conclusion

Quicken has been around for a while and use to be one of the only financial management app worth using.

With the rise of so many fintechs offering great alternatives, Quicken is no longer king of the hill.

Quicken 2018 For Mac Manual

For those who are focused on budgeting, Mint, YNAB and EveryDollar are great apps. Of those, Mint is free and EveryDollar offers a free option. Although, you'll likely want to pay for the upgrade to avoid manually entering in all of your transactions.

Quicken For Mac Alternatives 2018 Conference

While Personal Capital isn't as strong on the budgeting side, it makes up for it in investment analysis.

Quicken For Mac Reviews

Linking your accounts doesn't cost anything and you'll have all of Personal Capital's investment tools at your disposal.